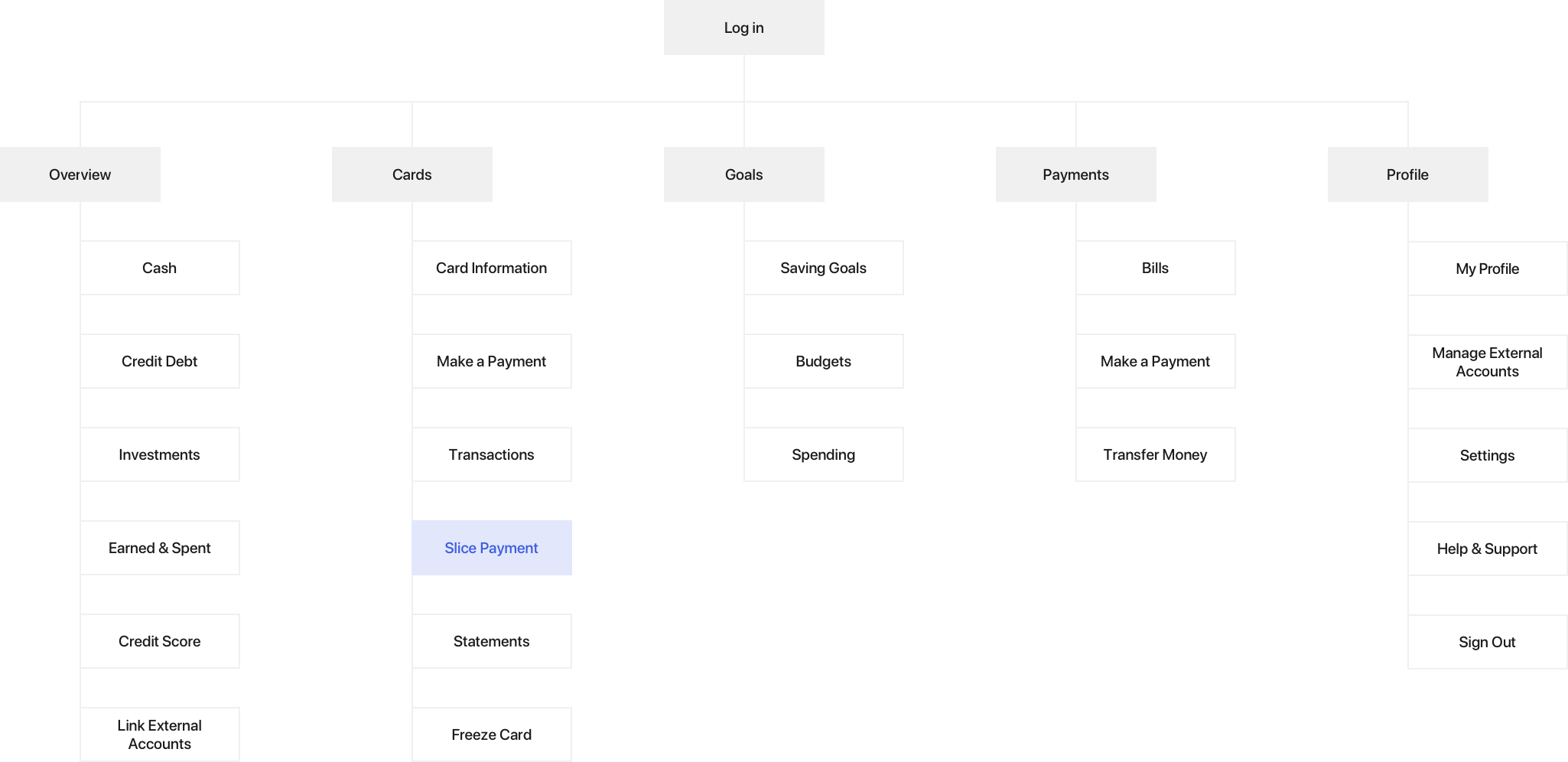

I created an app map to help me think through the structure and decide how best to display the information.

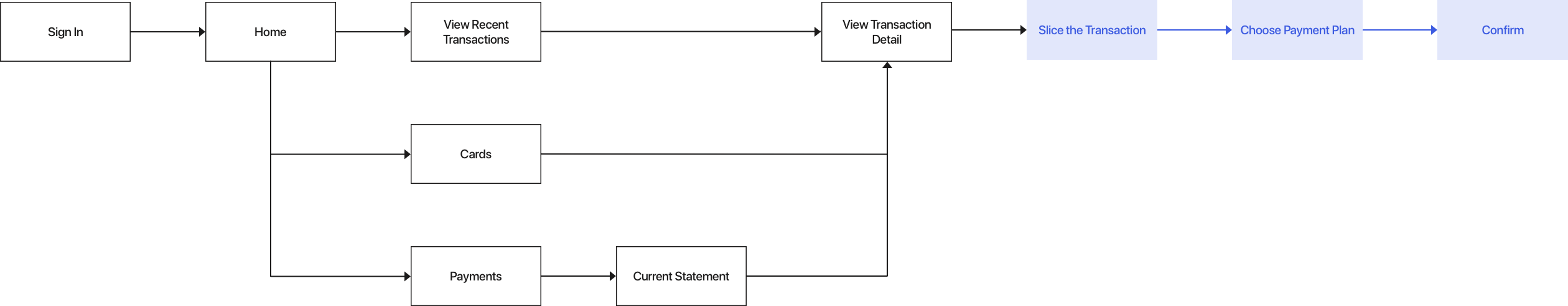

I also created a task flow that maps out the series of steps a user would take complete the task.

US consumer credit card debt hit a record high, exceeding $1.023 trillion in 2018. Millions of Americans are trapped with excessive credit card debt that feels impossible to overcome.

Rally is a new digital bank that aims to help its customers tackle their financial challenges and improve the financial health.

The challenge for Rally is creating features that help credit card holders better manage their credit card debt and personal finances.

UX research, Strategy, Information Architecture, UX/UI design, Usability testing

September 2017

As a first step, I conducted secondary research to understand American credit card trends and habits. Research shows that millennials consumers have unhealthy credit card habits:

Following the market research, I interviewed eight individuals to understand their spending habits and how they manage their credit card debt. From the interviews, I've learned that:

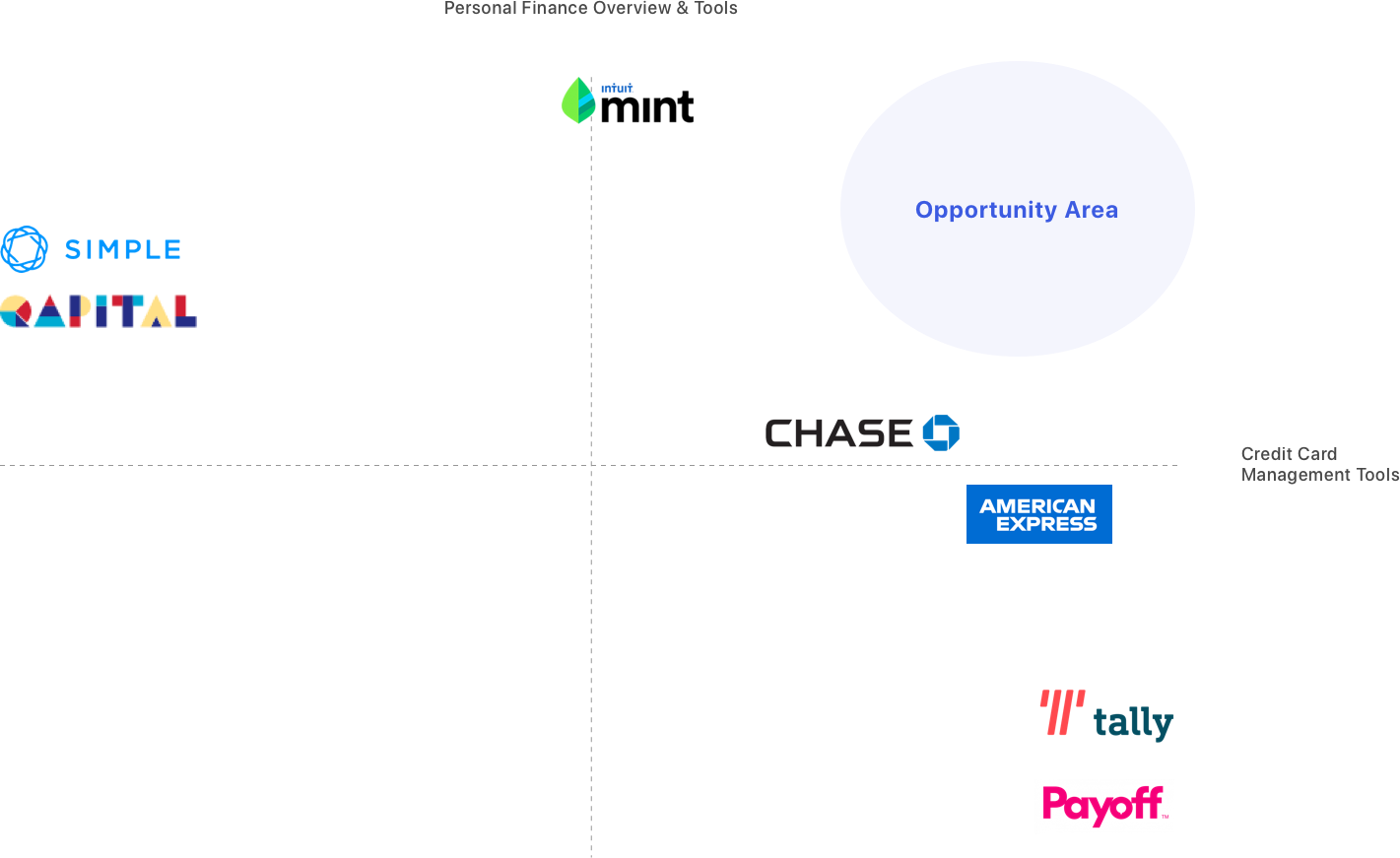

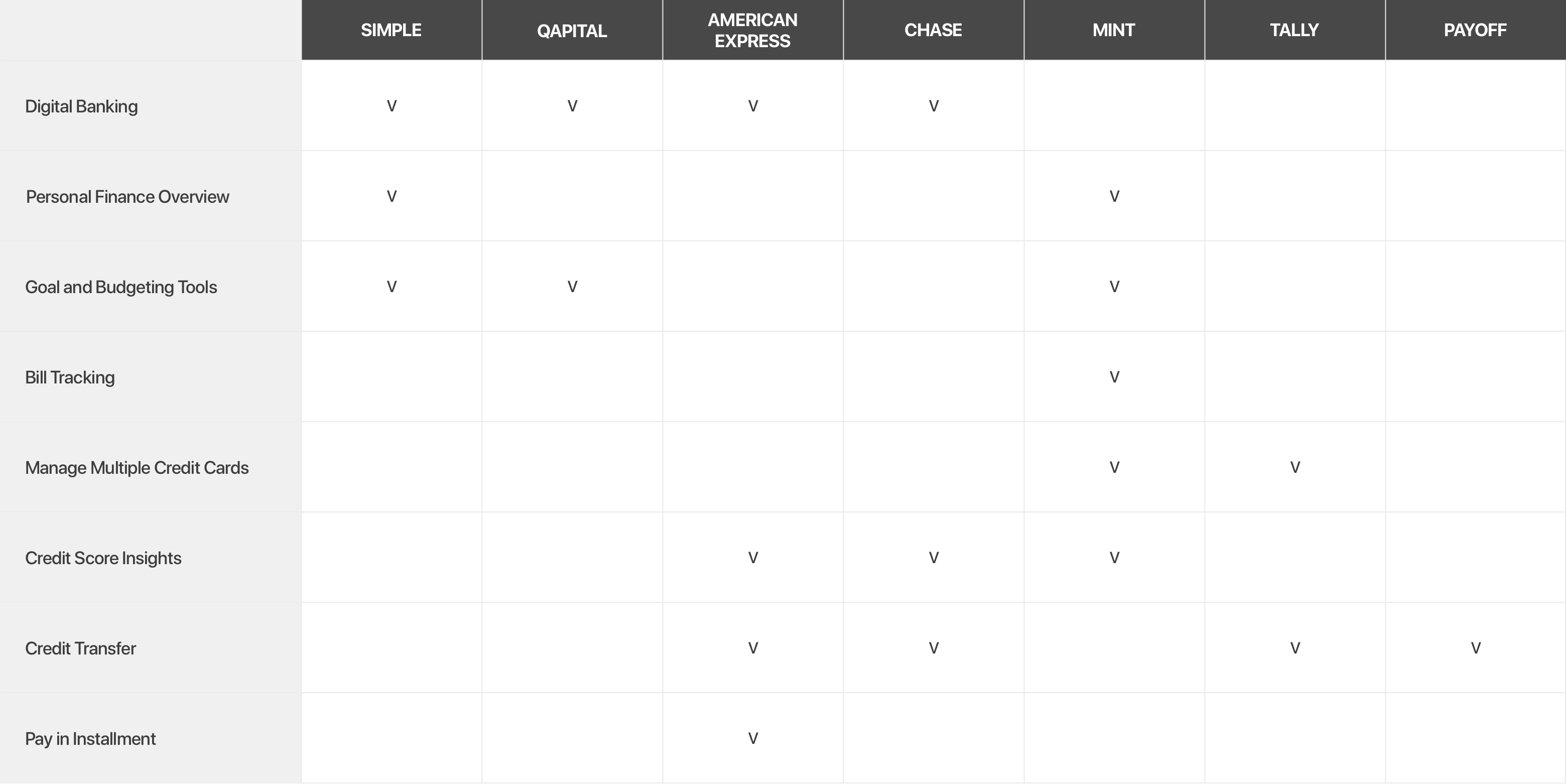

Then, I conducted a competitive analysis to study how other products tackle the similar problems and identify opportunities to improve Rally’s competitive advantage.

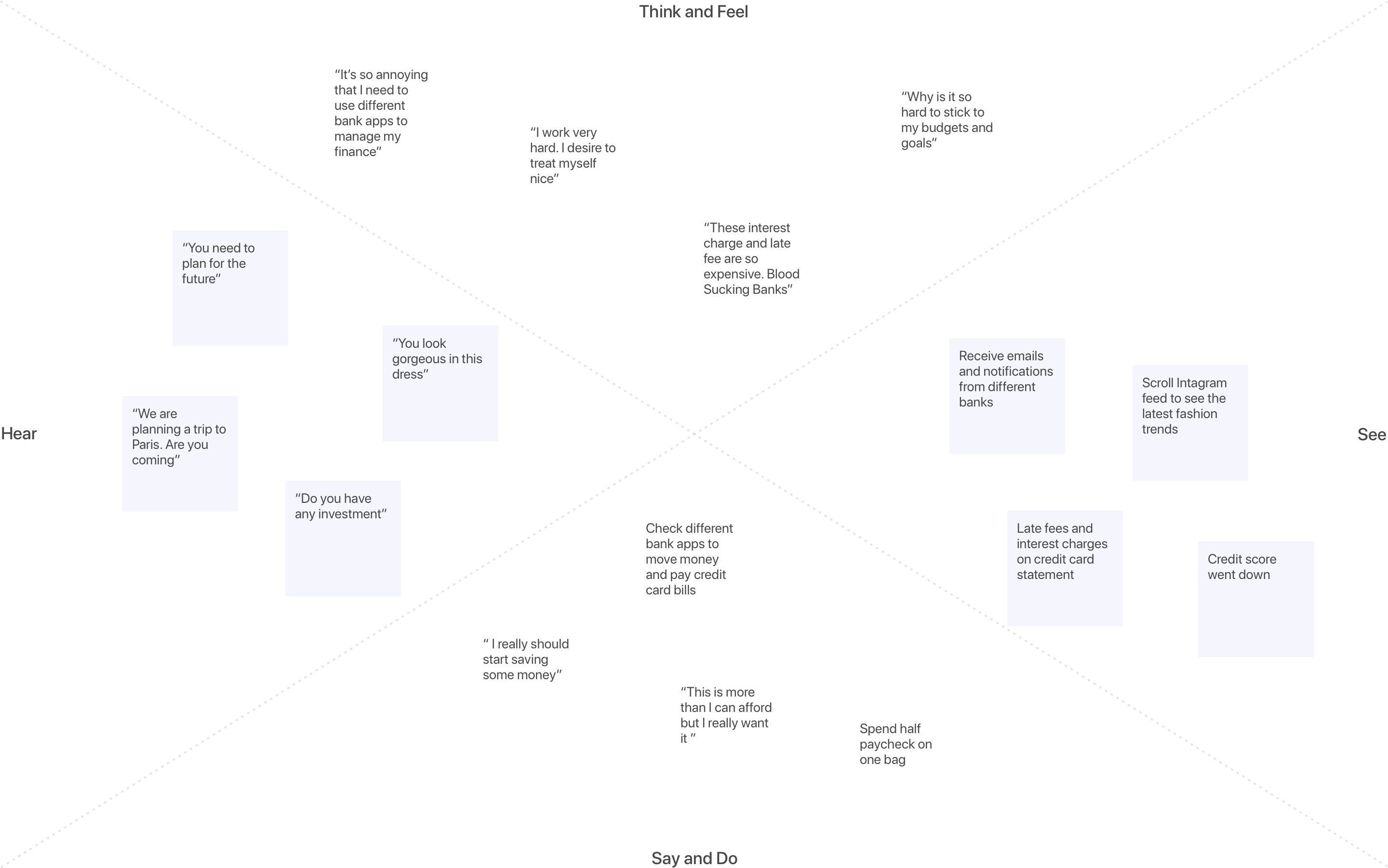

Following the interviews, I created an empathy map to synthesize the information. By doing so, I uncovered insights from my observations, which helped identify implicit user needs.

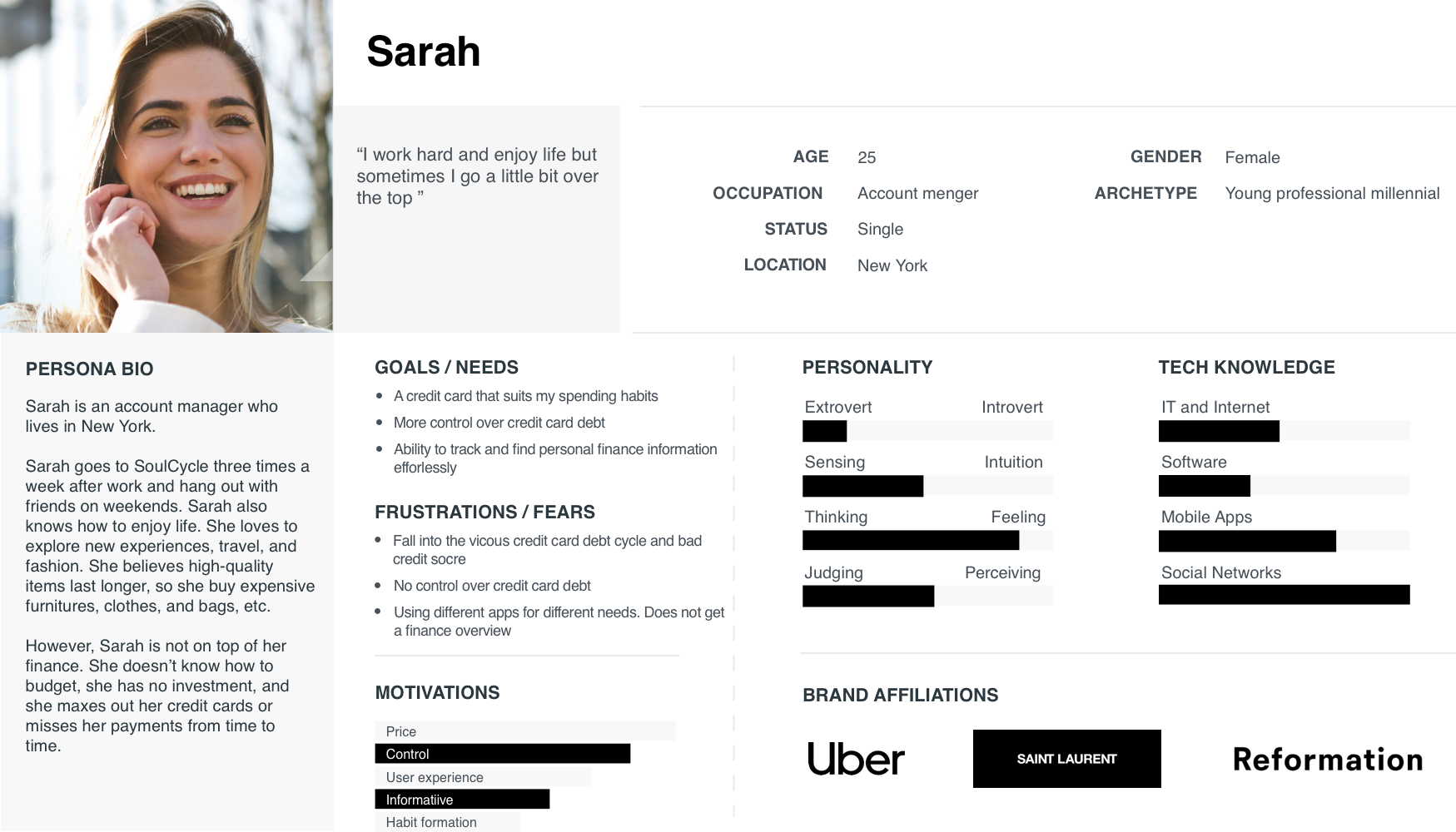

Based on these insights, I created a persona for young professional millennials to address their needs and frustrations.

After identifying our target users, I created one user story to help me brainstorm features that would address their needs and frustrations.

I want a credit card that suits my spending habits so that I don't have to worry about falling into vicous debt cycle and bad credit score.

I performed a usability test among individuals who represented my persona. I recorded each unique behavior and user comment on post-it notes. Finally, I created an affinity map to organize my notes into different patterns based on how the users interacted with the prototype.